Billions of pounds of NHS savings under threat from rising Government tax

Member login

By using the members area you have already agreed to share your personal information with the BGMA/BBA so that you can access the members materials. We will store your details only as long as you are a member. Your personal information will not be shared any affiliated companies or third parties. For more information about our Privacy Policy, click here.

- Off-patent sector trade association publishes its proposals to reform “out of control” VPAS tax

- 2023 will be second successive year that the VPAS tax on branded generic and biosimilar medicines takes wipes out all or virtually all of the growth from the entire sector

- Despite nearly half the products currently in VPAS being branded generic or biosimilar medicines, the BGMA has been excluded from full participation in the negotiations

The British Generic Manufacturers Association (BGMA), the representative trade body for off-patent prescription medicines, has said billions of pounds of NHS savings and increased patient access are under significant threat unless there are major reforms to a government pricing scheme.

The voluntary scheme for branded medicines pricing and access (VPAS) is an agreement between the Department of Health and Social Care (DHSC), NHS England and The Association of the British Pharmaceutical Industry (ABPI).

The scheme aims to limit increases in spending on branded medicines to no more than 2% per year via a rebate system which is charged on companies’ sales revenues. Two years ago, the rate was 5.1% but for 2023 it has soared to 26.5%.

The rocketing rate is in large part due to the growth in spend in on-patent medicines since 2019. Looking at the four completed years of the current VPAS scheme, data shows that the average annual growth rate for on-patent medicine sales value from 2019-22 was 18% compared to just 2% for off-patent products.

Approaching half the products in the current scheme are a branded generic or biosimilar medicine and therefore already subject to competition but for reasons - often tied to regulatory compliance - they are required to have a brand and pay the VPAS rebate rate as well.

Branded generics and biosimilars already create vast annual savings to the NHS by creating competition to originator products. For example, branded generics and biosimilars are commonly 80% less than what the originator price was on patent.

As a result of the lower prices paid by the NHS many more patients can also be treated, widening access. For example, the number of rheumatoid arthritis patients treated has expanded since the introduction of competition by 20-50% with biosimilar treatments costing between 70-95% less.

Research by the London School of Economics and the Office of Health Economics showed that the NHS would pay £7.8bn in higher medicine prices, if the VPAS levy stays at the current rate for branded generics and biosimilars for the next five years. This is because of product withdrawals and a decline in new off-patent product launches which reduces competition. Based on the Integrated Care Boards that have declared their annual budgets and medicines spend, this means that each of the 42 ICBs - how the NHS is organised at a local level - will each year up to 2028 be faced with paying 10% more for medicines or may have to ration drugs or other spend by the equivalent amount.

Mark Samuels, Chief Executive of the BGMA, said: “Generics and biosimilars are the life blood of the NHS fulfilling four out of five prescriptions and delivering to the UK the lowest medicine prices in Europe. These savings mean hundreds of thousands of additional patients can be treated each year. However, this success story is under significant threat from the out-of-control VPAS tax which has increased a staggering five-fold in under two years.

“Nearly half of all products covered in the current scheme are branded generics or biosimilar medicines meaning they face the twin pressures of competition and the rising VPAS rate. These medicines already operate on razor-thin margins and the VPAS payments can often make them loss-making and unsustainable to viably supply. Indeed, in 2022, based on the proportion of branded generic and biosimilar spend across all branded medicines, the 15% VPAS tax paid to Government by manufacturers of branded generic and biosimilars tallied £302m. This is 93% of the entire growth that all generic and biosimilar companies achieved last year (£326m).

“In 2023, the tax is 26.5% of companies branded medicines sales, which will almost certainly mean that what branded generic and biosimilar companies pay to Government is more than the sector’s overall growth. This is in stark contrast to the Government’s warm words on turbo-charging growth and supporting the whole life sciences sector.

“The principles of the scheme are right, but it cannot be correct that products which already deliver vast savings from competition are hit with this additional payment which means their whole viability is under threat which in turn has a massive impact on the NHS. It is also clear that the growth in spending is being driven by on-patent products which are effectively being subsidised by the off-patent sector. Originators supplying on-patent medicines paying a larger share of the VPAS tax, but their year-on-year growth rate is collectively far higher.”

The BGMA’s VPAS position publication correlates with what expert analysts and academic researchers have also published on the scheme. Earlier this month, three respected health policy institutions, the LSE, the University of York and the London School of Hygiene and Tropical Medicine, published a report entitled: “Promoting population health through pharmaceutical policy: The role of the UK Voluntary Scheme”.

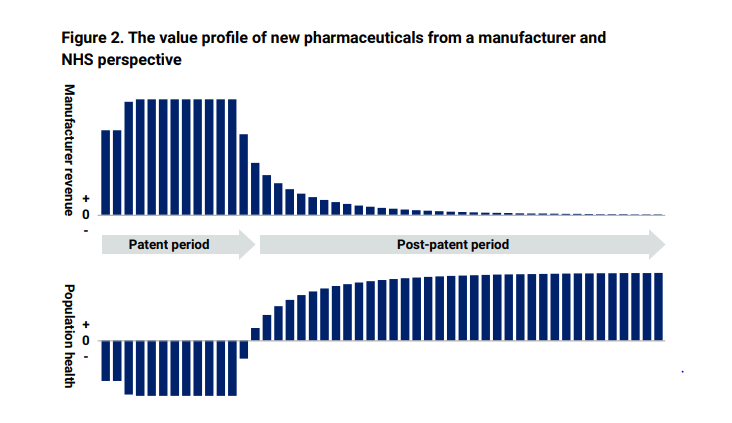

The report set out “how a medicine’s value is distributed between the manufacturer and NHS patients over its life cycle. During the on-patent period, revenue mainly accrues to the manufacturer due to the drug’s monopoly protection. During this period, NHS patients experience a health deficit as the new medicine’s benefits are outweighed by the impact on other NHS services. After the patent period, NHS patients start receiving significant net benefits from the availability of cheaper generic or biosimilar versions of the medicine”.

The report sets this out in two graphs. Taken together, they show why it is so important that the Government fosters a healthy off-patent market, since it is the introduction of generic and biosimilar. competition which triggers prices to fall following patent expiry, enabling wider access for patients who can be treated with the right medicines, sooner.

Mark Samuels added: “Negotiations have started on what the rate should be for the next five years starting in 2024. Given the significant impact on branded generics and biosimilars as part of a vibrant and competitive off-patent sector, the BGMA has requested to be formally included as a negotiating partner with the Government. However, this request has been denied and we have started proceedings on a judicial review into this decision which is due to be heard at the end of this month. In the spirit of being a collaborative partner, today, we publish our detailed proposals on how the VPAS scheme can be reformed. We call on all involved in the discussions to take note of the recommendations which we believe would deliver a more predictable, transparent, and equitable scheme.”

The BGMA’s position paper details how a financially sustainable VPAS can support widened medicines access to patients. It includes five key negotiating objectives:

- Deliver access to an affordable and sustainable supply of medicines for patients and the NHS that improve population health, reduce health inequalities, and boost UK economic productivity and investment.

- Recognise the critical role played by branded generics and biosimilars in the context of patient access to these medicines, securing best value for the taxpayer pound and the development of the broader life sciences ecosystem.

- Foster a competitive off-patent sector - where the next scheme complements the fluidity of competitive markets, with the VPAS levy considering the price of a medicine, the competition it is subject to and the NHS savings it generates.

- Ensure that the UK is a leader in the use of biosimilars, providing essential NHS cost savings while delivering earlier and widened access for patients.

- Make the UK a globally attractive environment for companies investing in and launching off-patent medicines, where licences can be acquired promptly, and the NHS receives the stock allocations it needs.

The paper also outlines specific reforms under three headings of differentiability, equitability, and predictability.

Under differentiability, the paper calls for the following actions:

- Recognition that off-patent, competitive markets behave differently to on-patent, single-source supply, with the BGMA afforded equal status in representing the off-patent sector in the negotiations.

- One VPAS, two segments; with different provisions applying to the branded on- and off-patent sectors.

- For branded off-patent medicines, an exemption from VPAS where the selling price of off-patent medicines to the NHS has been discounted 30% or more compared with the originator List Price pre-loss of exclusivity; or where off-patent medicines have been supplied to the NHS through hospital tenders.

- A more reasonable process of agreeing an NHS maximum price increase: one that does not disincentivise those firms with larger portfolios where the applicant must claim an individual price increase is warranted because of diminished profitability across its portfolio. The DHSC should clarify that profitability can be measured on an individual product basis. Since off-patent medicines operate in more dynamic markets, price application decisions should also be made in a more expedited timeframe.

- The next VPAS should promote uptake of the best-value biologic through ‘NHS system’ incentives that recognise the administrative cost of switching patients. This will support biosimilar competition and lead to more NHS savings by providing for larger, more predictable patient usage levels.

Under equitability, the paper calls for the following actions:

- Designing a system that seeks a fair and progressive contribution among suppliers based on the products they market and the NHS savings they generate.

- The low-value sales exemption, which has been set at £2 (NHS Maximum Price) for at least 10 years, should be increased to £10 to protect the supply and viability of the lowest-cost branded medicines.

- There should be greater transparency for what the NHS is paying for a medicine. Like other on- and off-patent presentations, medicines purchased by the NHS under special commercial arrangements should still have a Drug Tariff price listed, and their presentation level sales data should be shown in the Prescription Cost Analysis.

- Multi-year funding and access arrangements, which promote innovative preventative treatments, should also be made available in the NHS regardless of whether those treatments are patented.

- We must be mindful of the relationship between companies which supply UK-licensed branded medicines and make a VPAS contribution, and those which bring medicines into the UK under a Parallel Import (PI) licence that do not. A high VPAS rate will promote further growth in PIs1 and create supply volatility by actively discouraging the holding of UK licences and a UK life sciences base built around them; the exact opposite of what VPAS is designed to nurture.

Under predictability, the paper calls for the following actions:

- A controlled expenditure scheme similar to the current VPAS.

- Allowed year-on-year VPAS growth in line with the previous five (non-Covid) years of healthcare spending or pegged against future projections.2

- A Payment Percentage review clause if official UK inflation reaches a certain pre-agreed figure, or if required by a health emergency.

ENDS

growth in PIs1 and create supply volatility by actively discouraging the holding of UK licences and a UK life sciences base built around them; the exact opposite of what VPAS is designed to nurture.Under predictability, the paper calls for the following actions:•A controlled expenditure scheme similar to the current VPAS.•Allowed year-on-year VPAS growth in line with the previous five (non-Covid) years of healthcare spending or pegged against future projections.2•A Payment Percentage review clause if official UK inflation reaches a certain pre-agreed figure, or if required by a health emergency.ENDSFor further information about the BGMA please contact Jeremy Durrant on 07792918648 or email Jeremy.durrant@britishgenerics.co.uk

About the British Generic Manufacturers Association (BGMA)

The BGMA is made up of members of the generic manufacturing supply industry, who between them account for approximately 85% of the total UK generic market by volume. A key feature of the strong generics industry in the UK is that it introduces competition to the supply of prescription medicines making them more affordable to the NHS and enhancing their availability to patients.

According to NHS figures (NHS Digital), more than a billion items are prescribed generically every year. The competition provided by generic medicines saves the NHS around £15billion annually.

1Although PI branded sales do not count towards the measured sales under VPAS, they totaled £913m in 2022: https://www.gov.uk/government/publications/voluntary-scheme-aggregate-net-sales-and-payment-information-february-2023/aggregate-net-sales-and-payment-information-february-2023

2Looking at Spring Budget 2023, NHS England expenditure levels will average year-on-year growth of 7.62% between 2021-25, albeit with a 16.23% jump from 2021-22 to 2022-23. Spanning part of the next VPAS period, smaller year-on-year rises of 3.21% and 3.43% are planned to take place from 2022-23 to 2023-24 and from 2023-24 to 2024-25 respectively.